Is the Decline in Big Tech Stocks Just a Temporary Setback?

For months, the AI-driven tech surge on Wall Street seemed unstoppable — until Donald Trump shifted the narrative.

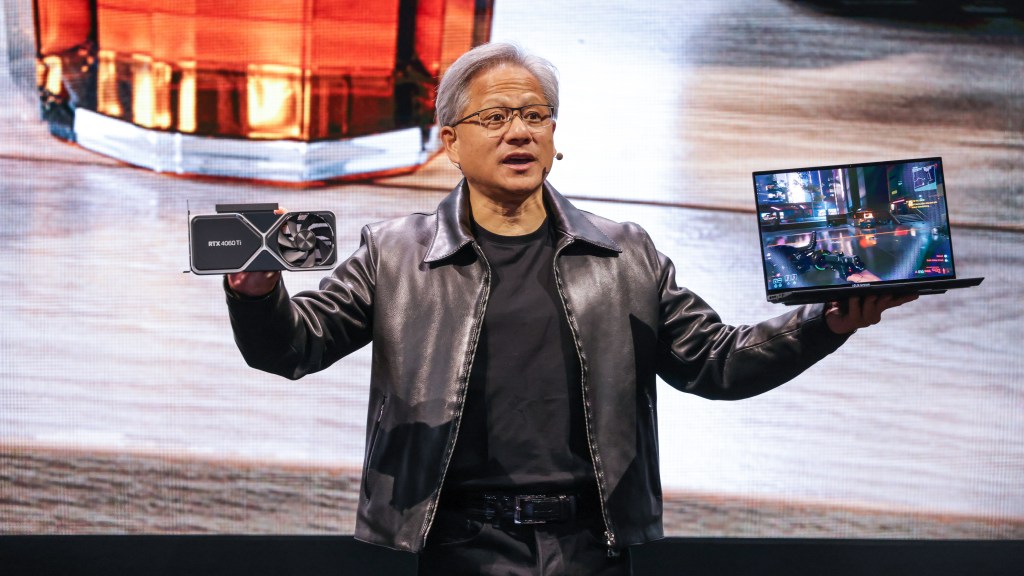

On Wednesday, the Nasdaq Composite experienced its steepest drop in nearly two years as investors moved away from Big Tech, wiping over $200 billion of market value from Nvidia, the chip manufacturer. The S&P 500 also fell, suffering additional losses along with the Nasdaq on Thursday.

Trump, the Republican presidential candidate, unsettled markets after a Bloomberg interview on Tuesday night in which he seemed indifferent to defending Taiwan, a crucial supplier of the world’s microchips. This supply chain is integral to almost every major tech company and is under threat from China.

These remarks came at a time when investors were already anxious about high valuations of major companies. The so-called Magnificent Seven, comprising Alphabet (Google’s parent company), Amazon, Apple, Microsoft, Meta Platforms, Nvidia, and Tesla, represent about a third of the S&P’s total value, their shares surging this year due to AI-driven market optimism.

Investors were already beginning to favor companies with smaller valuations over heavyweight stocks, driven by the expectation that the US Federal Reserve might cut interest rates in September. Smaller-cap stocks, usually more impacted by borrowing costs, could benefit from such a monetary policy shift.

Dan Ives, a New York-based analyst at Wedbush Securities and a technology bull, remains confident. “We believe Trump’s rhetoric is more bark than bite,” he said. “It’s a high-stakes game in a political campaign. The AI boom is still early, and we don’t think Trump, if elected, will end it.”

Ives compared the current tech surge to the 1995 dotcom boom, when the internet drove company valuations sky-high before the bubble burst in the early 2000s. “It’s reminiscent of 1995,” he noted. “The growth fueled by AI is just beginning.”

Analysts predict strong second-quarter earnings for Alphabet next week, followed by Microsoft, Meta, and Apple, which could stabilize stock market valuations.

Alphabet’s stock has risen by 28% this year, buoyed by optimism about its AI capabilities in Search and YouTube, as well as AI-driven demand for its cloud services.

Microsoft, leading the AI revolution since partnering with OpenAI in 2019, saw a 19% rise this year before suffering losses during a global tech crisis. Meta’s shares have surged 37% this year, with significant investments in AI research and development.

Not everyone believes this growth is sustainable. Citigroup analysts recently suggested taking profits from “AI high-flyers” and diversifying into a broader range of AI stocks.

Concerns over concentrated valuation gains have heightened investment risks. Nvidia’s performance is closely tied to Microsoft, Google, and Meta buying its chips.

Stuart Kaiser, Citi’s head of equity trading strategy, predicts unpredictable market reactions to next week’s results due to high expectations. “They’ll likely deliver solid results, but the question is whether ‘good’ is good enough in this pressured tech stock environment,” he said.

Kaiser added that while Citi acknowledged AI’s transformative potential, it’s challenging to identify clear winners. Only 14 of their 36 AI stocks are up this year, leading investors to favor major players like Nvidia, Microsoft, and Apple.

“Investors prefer companies that can demonstrate immediate revenue or cost savings,” Kaiser said, highlighting a cautious investment approach.

Skepticism about AI’s transformative potential on costs and revenue is growing. Jim Covello, Goldman Sachs’ head of global equity research, argued that AI isn’t solving the complex problems necessary for a high return on its $1 trillion development and running costs.

“There’s a fundamental misunderstanding of AI’s capabilities,” Covello told Goldman Sachs Exchanges, the investment bank’s podcast. “It’s not addressing significant problems and lacks cognitive reasoning.”

Daryl Jones, director of research at Hedgeye Risk Management, believes the tech bull run will continue but sees inflation as a long-term market risk post-2024 rate cuts.

“In the short term, interest rate cuts are positive for the market and may boost the small-cap rally,” Jones said. “However, the biggest risk is inflation re-accelerating later in 2024, making us reassess the timing of these cuts.”

While analysts doubt Trump’s comments reflect future policies if he wins, other factors suggest continued volatility for tech stocks this year.